Cetus Protocol

CETUS

Cetus Protocol Хронология

Cetus Protocol Распределение токенов

Cetus Protocol БазовыйСообщить об ошибке в данных

Cetus Protocol Инфо

Cetus Protocol Введение

Cetus is a pioneer DEX and concentrated liquidity protocol built on the Sui and Aptos blockchain. The mission of Cetus is building a powerful and flexible underlying liquidity network to make trading easier for any users and assets. It focuses on delivering the best trading experience and superior liquidity efficiency to DeFi users through the process of building its concentrated liquidity protocol and a series of affiliate interoperable functional modules.

Permissionless All the major tools and functions on Cetus are basically built with a permissionless standard. It allows users or other applications to utilize its protocols for their own use cases at any time. No matter it’s to set up a new trading pool, or to allocate incentives to rent liquidity from the public. Programmable Cetus is building a highly-customizable liquidity protocol based on CLMM. Through flexible composition of swap, range order and limit order, users can almost conduct all kinds of complex trading strategies that could be achieved on a CEX. Besides, liquidity providers are also able to execute various Maker strategies using CLMM to maximize their liquidity efficiency. Composability Cetus embraces the concept of “Liquidity As A Service”, so it puts emphasis on the ease of integration when building its products. Developers and applications can easily access the liquidity on Cetus to build their own products such as liquidity vault, derivatives, leveraged farming, etc. A new project team can also easily set up a swap interface on its own front end by integrating Cetus SDK, which will help them access the liquidity of Cetus and even the whole market real quick. Sustainability Cetus adopts a double-token model fueled by CETUS and xCETUS.

Long term and dynamic incentivization sustained by protocol earnings is implemented to reward those active participants of the protocol. It wants to make sure the real contributors of the protocol can be effectively incentivized by the scientific token economy.

Cetus Protocol Разблокиров. и расп.Сообщить об ошибке в данных

Cetus Protocol Хронология

Cetus Protocol Распределение токенов

Вопросы и ответы о токеномике Cetus Protocol.

Explore the tokenomics of Cetus Protocol(CETUS) and review the project details below.

What is the allocation & supply schedule for Cetus Protocol(CETUS) ?

Cetus Protocol employs a dual-token system comprising CETUS and xCETUS. The CETUS token serves as the native utility and governance token, while xCETUS is a non-transferable escrowed governance token obtained by staking CETUS.

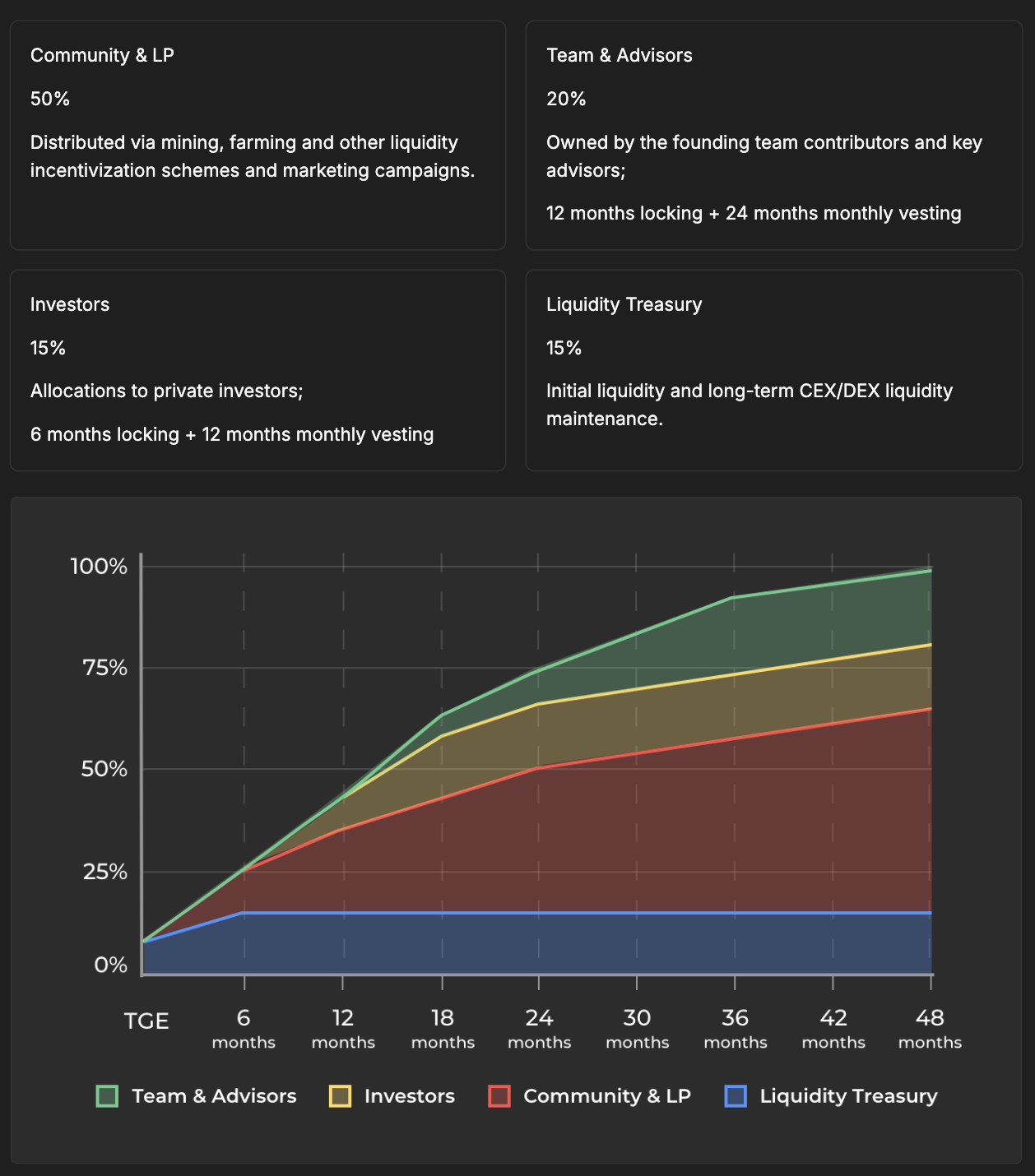

Token Allocation:

The total supply of CETUS tokens is capped at 1,000,000,000. The distribution is as follows:

- Community & Liquidity Providers: 50% (500,000,000 CETUS)

- Team & Advisors: 20% (200,000,000 CETUS)

- Investors: 15% (150,000,000 CETUS)

- Liquidity Treasury: 15% (150,000,000 CETUS)