Ethena

ENA

Ethena Хронология

Ethena Распределение токенов

Ethena БазовыйСообщить об ошибке в данных

Ethena Инфо

Ethena Введение

Ethena is an innovative startup based in Portugal, aiming to pioneer new developments in the realm of algorithmic stablecoins. Its core product, USDe, is an Ethereum-based synthetic dollar that offers enhanced scalability, stability, and resistance to censorship, setting it apart from traditional stablecoins. USDe is more than just a stablecoin; it’s a yield-bearing synthetic asset that leverages innovative mechanisms to maintain its peg to the US dollar while generating returns.

The issuance of USDe is backed by user-provided collateral, with price exposure hedged through shorting Ethereum perpetual swaps, ensuring the stablecoin maintains its 1:1 peg to the US dollar even in volatile market conditions. Learning from the failures of previous projects like Terra, Ethena has designed a robust risk management framework to avoid common pitfalls of algorithmic stablecoins, creating a more resilient system.

In addition to USDe, Ethena is also developing an innovative financial product known as the Internet Savings Bond, which is denominated in USD. This bond combines staked Ethereum (stETH) with derivative market yields, providing investors with a secure way to earn passive income. By lowering the barriers to entry, Ethena enables everyday users to participate in the digital asset economy and enjoy returns generated from these cutting-edge financial tools.

Ethena's mission extends beyond simply developing a stablecoin; it aims to redefine the use of digital currencies and savings mechanisms by blending technological innovation with new financial instruments, driving the adoption and growth of decentralized finance (DeFi) on a global scale.

Ethena Разблокиров. и расп.Сообщить об ошибке в данных

Ethena Хронология

Ethena Распределение токенов

Вопросы и ответы о токеномике Ethena.

Explore the tokenomics of Ethena(ENA) and review the project details below.

What is the allocation & supply schedule for Ethena(ENA)?

Total Supply and Initial Circulation

The total supply of ENA is capped at 15 billion tokens, with an initial circulating supply of 1.425 billion tokens.

Allocation Breakdown

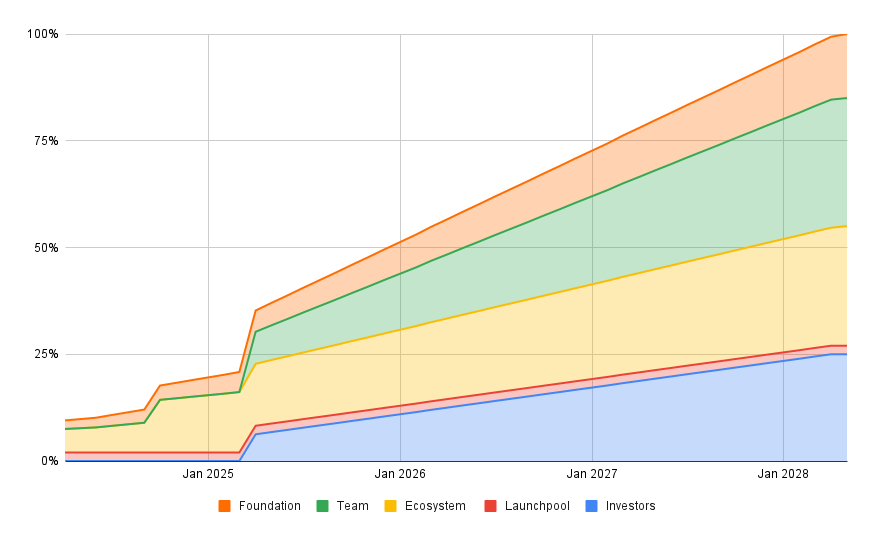

- Core Contributors (30%): This allocation is designated for the Ethena Labs team and advisors instrumental in bringing the USDe protocol to fruition. These tokens are subject to a 1-year cliff, after which 25% becomes available, followed by linear monthly vesting over the subsequent three years. No tokens are unlocked before the 1-year mark.

- Investors (25%): Allocated to investors who have provided essential backing for the development of the Ethena protocol and its Reserve Fund. These tokens follow the same vesting schedule as the core contributors, with a 1-year cliff and subsequent three-year linear monthly vesting.

- Foundation (15%): Managed by the Ethena Foundation, this portion is dedicated to initiatives aimed at expanding the reach of USDe, reducing reliance on traditional banking systems, and supporting further development, risk assessments, and audits.

- Ecosystem Development and Airdrops (30%): This segment focuses on fostering the Ethena ecosystem. The initial 5% was distributed to users during the first season of the Shard Campaign. The remaining 25% is reserved for future initiatives, including subsequent incentive campaigns, cross-chain projects, and exchange partnerships, all governed by a DAO-controlled multisig wallet.

Vesting Schedule

The vesting schedule is designed to promote long-term commitment from contributors and investors:

- 1-Year Cliff: No tokens are released during the first year.

- Post-Cliff Vesting: After the 1-year cliff, 25% of the allocated tokens are unlocked, with the remaining 75% vesting linearly on a monthly basis over the next three years.