SynFutures

F

Ortalama

0

0

0

Ortalama

0

0

0

Ortalama

0

0

0

Ortalama

0

0

0

SynFutures Zaman çizelgesi

SynFutures Jeton açma

SynFutures Jeton tahsisi

SynFutures TemelVeri Hatasını Bildir

SynFutures Bilgi

SynFutures Takım

SynFutures Giriş

SynFutures is a leading decentralized finance (DeFi) platform that is redefining futures trading in the cryptocurrency domain. The platform provides a fully decentralized and permissionless futures market, enabling users to trade a wide array of assets without the need for traditional financial intermediaries.

At the core of SynFutures is the innovative Oyster AMM (Automated Market Maker) model, which provides single-token concentrated liquidity tailored for derivatives trading. This model allows liquidity to be concentrated within specific price ranges and integrates leverage to enhance capital efficiency. Compared to traditional AMM systems like Uniswap v3, which focus on spot markets, Oyster AMM supports a margin management and liquidation framework designed specifically for derivatives, making the trading environment more efficient.

In its third version, SynFutures introduced a permissionless on-chain order book model that improves upon traditional AMM models by concentrating liquidity around the mid-price and enhancing capital efficiency. This model achieves transparency and immutability in trading operations.

Furthermore, the Oyster AMM seamlessly integrates concentrated liquidity and an order book into a single model, providing a cohesive liquidity system for both active traders and passive liquidity providers. This ensures efficient and predictable transactions. Additionally, the platform employs advanced financial risk management mechanisms, including a dynamic penalty fee system to prevent price manipulation and stabilize pricing, thereby enhancing user protection and maintaining price stability.

SynFutures Kilit Açma ve TahsisVeri Hatasını Bildir

SynFutures Zaman çizelgesi

SynFutures Jeton açma

SynFutures Jeton tahsisi

SynFutures Tokenomik hakkında Soru-Cevap

Explore the tokenomics of SynFutures (F) and review the project details below.

What is the allocation & supply schedule for SynFutures (F)?

Total Supply and Initial Unlock:

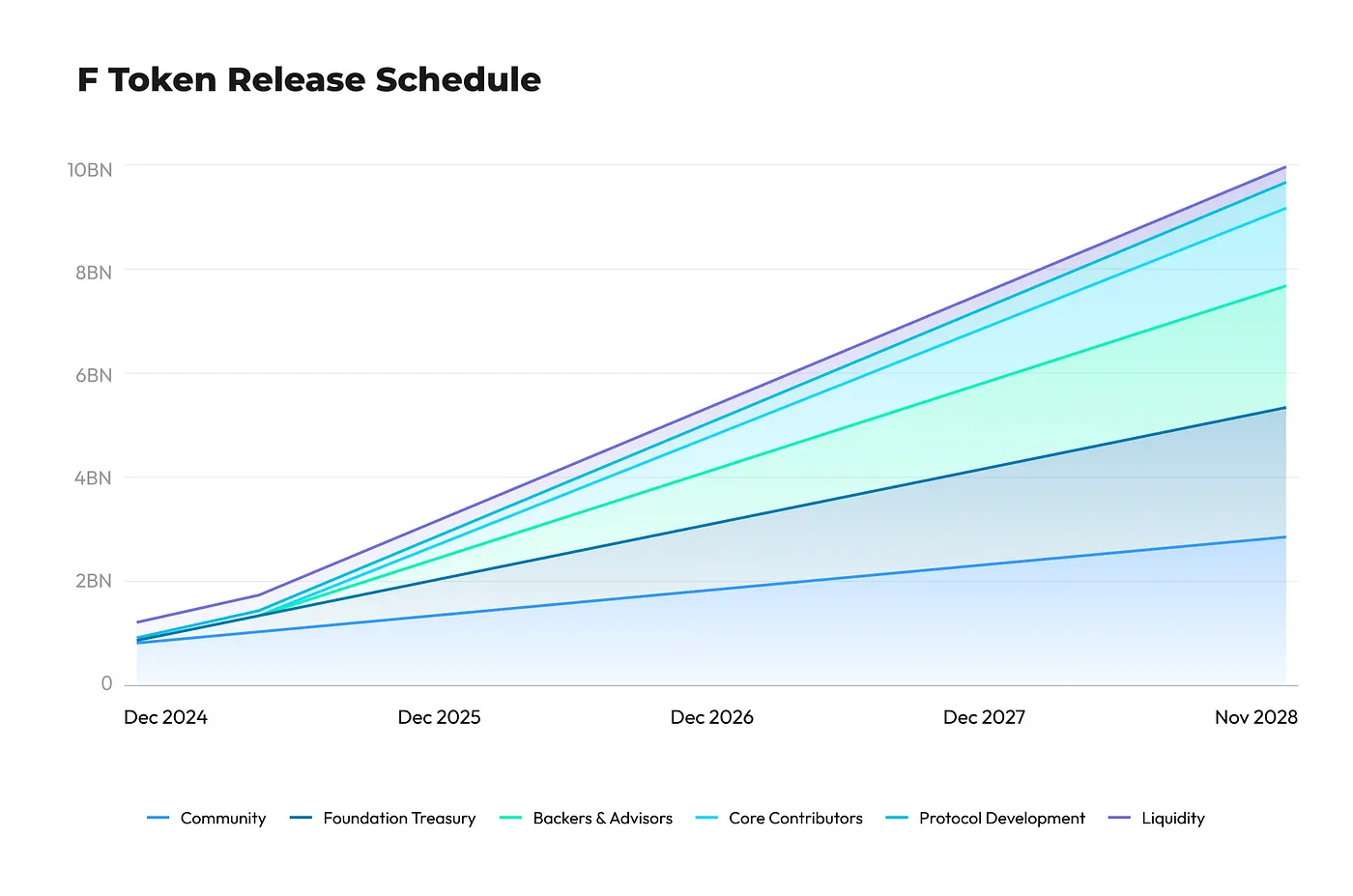

- The F token has a total supply of 10 billion tokens.

- At the Token Generation Event (TGE), 12% of the total supply, or 1.2 billion F tokens, will be unlocked.

Detailed Allocation:

- Community (28.5% - 2,850,000,000 F):

This allocation aims to reward community members, users, and contributors, fostering further growth and adoption of the SynFutures ecosystem.

- Airdrop (7.5% - 750,000,000 F): Airdrops will distribute 7.5% of the total supply to users actively engaged with SynFutures protocol versions 1, 2, and 3, with all airdrop tokens unlocked at TGE. An official announcement regarding the airdrop details is forthcoming.

- Ecosystem (20.5% - 2,050,000,000 F): Focused on ecosystem growth, this allocation supports incentive programs for new users, partnerships, grants for developers, and community engagement programs. This portion will unlock linearly over four years from TGE.

- Liquidity Campaigns (0.5% - 50,000,000 F): These funds are allocated to accelerate F token listing and trading on various exchanges, ensuring wider token adoption.

2. Backers & Advisors (23.5% - 2,350,000,000 F):

Reserved for backers and advisors who provide funding, expertise, and other support. This allocation follows a half-year cliff, then unlocks linearly over the next three and a half years.

3. Foundation Treasury (25% - 2,500,000,000 F):

These funds support the long-term stability and development of SynFutures. Strategic partnerships, operational costs, and sustainable development initiatives are key focus areas. Initially, 0.5% of the total supply (50,000,000 F) will be unlocked at TGE, with the remainder unlocking linearly over four years.

4. Core Contributors (15% - 1,500,000,000 F):

Recognizes the efforts of core contributors focusing on security, product, and infrastructure since day one. This allocation has a half-year lock-up, followed by a linear unlock over three and a half years.

5. Protocol Development (5% - 500,000,000 F):

Dedicated to funding ongoing R&D, engineering, and new features. This allocation supports competitive salaries, protocol audits, and research into new technologies. An initial 0.5% of the total supply (50,000,000 F) will be unlocked at TGE, with the remainder over four years.

6. Liquidity (3% - 300,000,000 F):

Ensures sufficient liquidity for the F token on exchanges to facilitate price discovery and seamless trading. The entire allocation will be unlocked at TGE.

Token Release Schedule: